- Aviva ancestor company insured Gold State Coach for £3,000 in 1911

- Employers encouraged to mark the 1953 coronation by launching a pension scheme

- 1953 celebration organisers urged to consider damage from maypoles

Aviva has revealed a glimpse into coronations past, demonstrating how the insurance world marked these historic occasions.

Documents from the Aviva archives relate to the crowning of previous UK monarchs, including their majesties George V in 1911, George VI in 1936 and Elizabeth II in 1953.

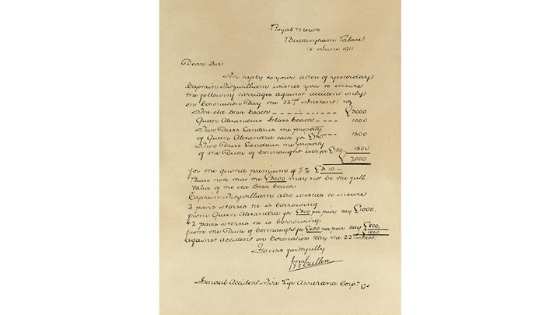

Items include a letter dated 14 June 1911, requesting insurance against accident for the Gold State Coach in coronation celebrations for George V and Mary. The coach was insured for a sum of £3,000 – equivalent to just over £285,000* today – although the letter does state: “Please note that the £3,000 may not be the full value of the old [sic] state coach” (image one). King Charles III is expected to take part in a procession with the Queen in the same gold coach on May 6th.

The Aviva records also include commemorative adverts, photos of celebrations at Aviva offices and proposals for insurance for “coronation celebrations”.

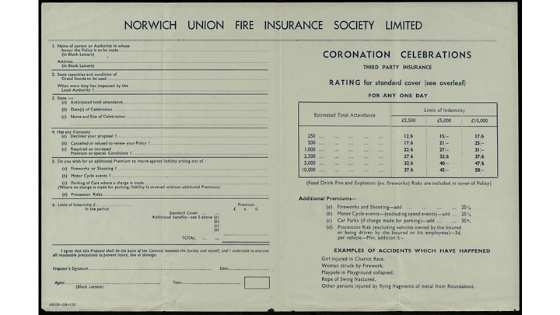

One proposal outlines insurance terms for events involving between 250 and 10,000 guests, with “food, drink, fire and explosion risks” covered. It also cites claim examples from previous events, including “rope of swing fractured” and “maypole in playground collapsed” (image two). Another similar leaflet advises that the risk of damage or injury is: “a burden which we can lift from the shoulders of the organizers” (image three).

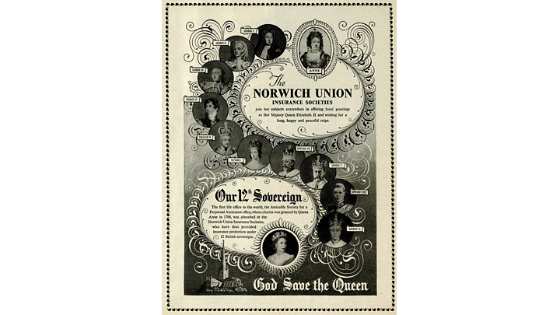

One advert celebrating Queen Elizabeth II’s coronation includes pictures of the 12 British monarchs under whose reigns the company had operated. The rather wordy advert reads: “The first life office in the world, the Amicable Society of a Perpetual Assurance office, whose charter was granted by Queen Anne in 1706, was absorbed in Norwich Union Insurance Societies, who have thus provided insurance protection under 12 British sovereigns” (image four).

Queen Elizabeth II’s coronation was clearly an exciting event for the company in 1953. Directors of Norwich Union, which later became part of Aviva, issued invitations asking guests to join them to watch the royal procession from its offices at 39 St James’s Street, Piccadilly (image five). The company also hired televisions so staff members and guests could watch the events.

Although it wasn’t all about pomp and ceremony. One Norwich Union advert from 1953 announced that the best way to mark the occasion of the coronation was “by launching a pension scheme for your employees” (image six).

While another poster from the archives shows how staff members celebrated with a cricket match between The Men of Hambledon and The Ancient Firemen, a team from Aviva ancestor company, Commercial Union.

Teams played in old time costumes according to old time rules. Admission was free, although there were “moderate charges” for seating and car parks (images seven and eight).

Anna Stone, Group Archivist for Aviva says: “Aviva’s origins can be traced back to 1696 when William III and Mary II reigned. King Charles III is the 14th monarch we have operated under. Our archives house some delightful documents which track how fashions and trends have changed through the years – and also how some things have stayed the same.

“The desire to celebrate remains strong and across the Aviva group, we’re looking forward to commemorating the occasion. We may well have a few new photos to add to our archives for the future!”

Coronation connections from the Aviva archives also include the following details involving a number of ancestor companies:

- In 1702, The Hand In Hand Fire and Life Insurance Society insured the royal wardrobe, where the coronation robes and hangings were stored.

- Sir William Chambers, who designed the Gold State Coach, and Joseph Wilton, who produced its elaborate carvings, both had fire insurance with Hand in Hand.

- The earliest references for Aviva heritage offices being decorated for a coronation come from the 1831 coronation of William IV. The London office of Union Assurance featured “ornamental lamps, prettily arranged”.

- In 1902, General Accident’s ledger records that the company spent £440 14s 1d on the festivities (equivalent to around £43,721* now) including £60 (£5,949 now) decorating the Perth head office, £130 (£12,889 now) setting up seating at the London office so guests could watch the procession, and £1 and 3 shillings on whisky (around £99 now).

- Aviva’s archive also includes details of insurance policies for motor cars for the late Queen Elizabeth II - ranging from Daimlers used for official visits, to Land Rovers, private cars and Ford vans used on the royal estates - and golfing and livestock insurance taken out by her father King George VI.

-ENDS-

Sources

*Figures according to Bank of England inflation calculator, 24 April 2023. Calculations to nearest whole pound.

Media Enquiries:

Sarah Poulter

UK External Communications

-

Phone

-

+44 (0) 7800 691 569

-

-

Email

Gallery

A selection of images from the Archive collection.

Notes to editors:

- We are the UK's leading diversified insurer and we operate in the UK, Ireland and Canada. We also have international investments in India and China.

- We help our 25.2m customers make the most out of life, plan for the future, and have the confidence that if things go wrong we’ll be there to put it right.

- We have been taking care of people for more than 325 years, in line with our purpose of being ‘with you today, for a better tomorrow’. In 2024, we paid £29.3 billion in claims and benefits to our customers.

- In 2021, we announced our ambition to become Net Zero by 2040, the first major insurance company in the world to do so. While we are working towards our sustainability ambitions, we recognise that while we have control over Aviva’s operations and influence over our supply chain, when it comes to decarbonising the economy in which we operate and invest, Aviva is one part of a far larger global system. Nevertheless, we remain focused on the task and are committed to playing our part in the collective effort to enable the global transition. The scope of our Climate ambitions and the risks and opportunities associated with our Climate strategy are set out in our Transition Plan published in February 2025: www.aviva.com/sustainability/taking-climate-action. Find out more about our sustainability ambition and action at www.aviva.com/sustainability

- Aviva is a Living Wage, Living Pension and Living Hours employer and provides market-leading benefits for our people, including flexible working, paid carers leave and equal parental leave. Find out more at www.aviva.com/about-us/our-people/

- As at 30 June 2025, total Group assets under management at Aviva Group were £419 billion and our estimated Solvency II shareholder capital surplus as at 30 September 2025 was £7.0 billion. Our shares are listed on the London Stock Exchange and we are a member of the FTSE 100 index.

- For more details on what we do, our business and how we help our customers, visit www.aviva.com/about-us

- The Aviva newsroom at www.aviva.com/newsroom includes links to our spokespeople images, podcasts, research reports and our news release archive. Sign up to get the latest news from Aviva by email.

- You can follow us on:

- X: www.x.com/avivaplc/

- LinkedIn: www.linkedin.com/company/aviva-plc

- Instagram: www.instagram.com/avivaplc

- For the latest corporate films from around our business, subscribe to our YouTube channel: www.youtube.com/user/aviva