- New easy-to-use website designed with Cambridge University launched to help place policies from 1700s onto a digital map

- Mapping out historic policies will help provide a picture of how London and insurance has evolved

- Aviva’s archive contains more than 325 years of insurance history

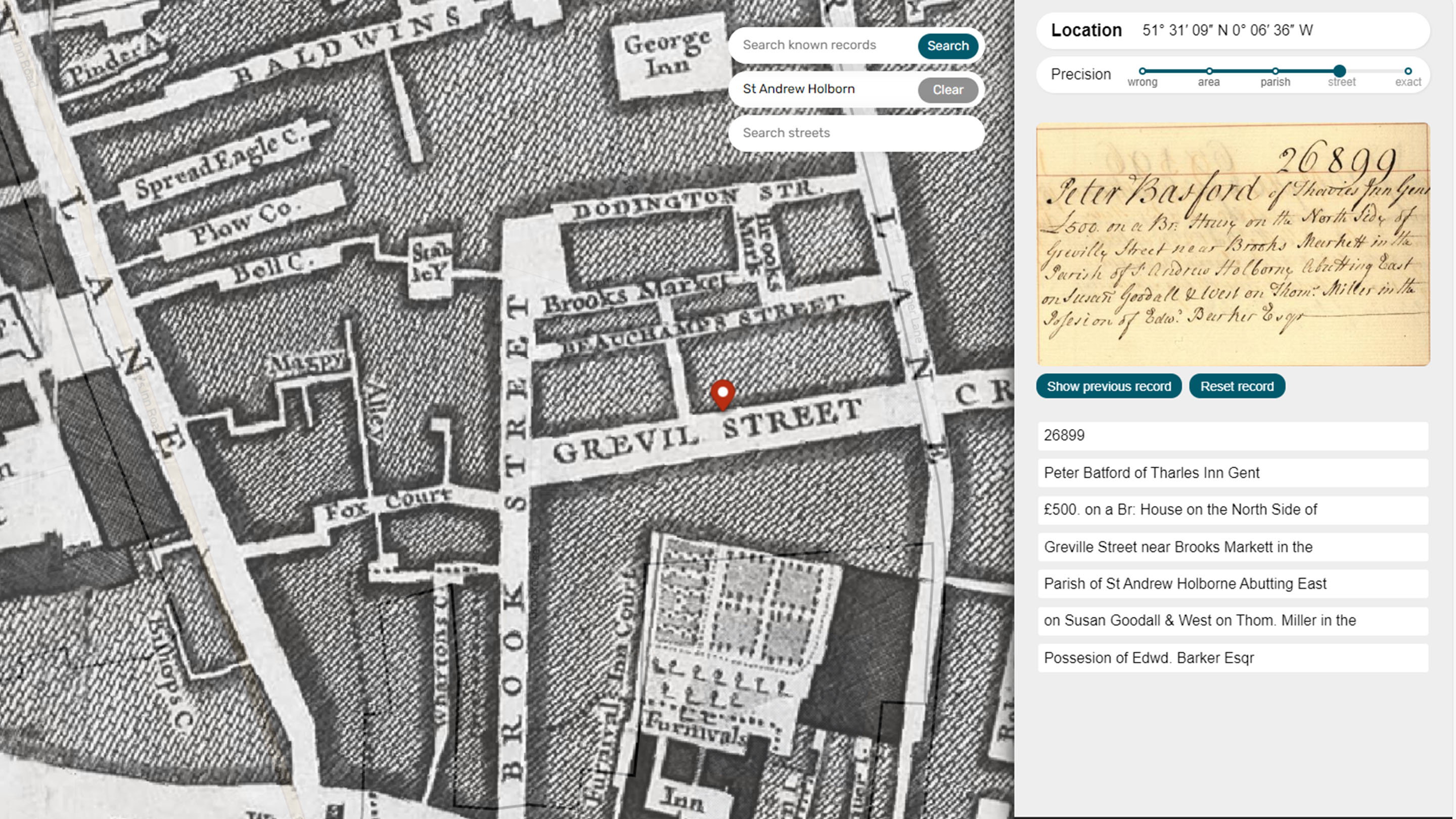

Aviva is inviting people to help map entries from historical policy registers using a new digital tool, developed in collaboration with Cambridge University. It provides extracts of digitised policy entries with automatic transcriptions produced using a handwriting recognition tool, helping users identify, and then map, policy details.

The original documents date back to the Hand in Hand Fire and Life Insurance Society, the oldest of Aviva’s heritage companies, with policy registers dating back to 1696. Mapping these historical policies will help Aviva’s specialist archive team learn more about their earliest customers, as well as providing information for family historians and adding to our understanding of how London looked hundreds of years ago. Aviva hopes to make the completed maps publicly available in the future.

The tool works by randomly allocating users one of the first 3,240 policies, which relate to addresses in London. The first postcodes were not introduced until 1959 and many houses in the registers did not have numbers, so using details of the parish, road names and other geographical markers (such as ‘west of the Tower’) extracted from the policy entry, users can navigate a historical map of London and mark the exact or approximate location of the policy, as well as amending an automated transcription of the policy wording. Once entries are validated, Aviva’s archive team extracts the corrected transcriptions together with the coordinates for the location of the property, providing a picture of the inhabitants and insurance of historical London.

This follows more than two years of work to digitise 150 volumes of historical Hand in Hand policies, covering around 550,000 entries. The details required for working out the insurance premium and identifying the individual property provide a unique window onto London in this period.

The tool can be found on Amicable Contributors.

Aviva’s archive was formed in 2000 when the three archives of Commercial Union, General Accident and Norwich Union were merged. The separate archive collections of Friends Provident and Sun Life were transferred to Aviva’s Norwich office in 2016. The archive contains records of more than 750 companies – an estimated 183,750 items – and fills 2.2km of shelving.

This is a unique opportunity for people to play a role in mapping London’s history.

Anna Stone, Aviva Group Archivist, said: “This is a unique opportunity for people to play a role in mapping London’s history, helping to build a picture of the vital role insurance has played in the growth of the capital over the centuries. The policy registers contain fascinating information about London properties from mansions and hospitals to workshops and poorhouses, helping us add new stories to those which we use to support the Aviva brand today by demonstrating all the ways we have helped and protected our customers throughout our history.”

The Hand in Hand was founded at Tom's Coffee House in St Martin’s Lane, London, on 12 November 1696. It was the UK's oldest existing fire insurance company when it was acquired by Commercial Union in 1905.

-ends-

Enquiries:

Claire Jermany Grange

Financial Communications

-

Phone

-

+44 (0) 7385 148 681

-

-

Email

Notes to editors:

- We are the UK's leading diversified insurer and we operate in the UK, Ireland and Canada. We also have international investments in India and China.

- We help our 25.2m customers make the most out of life, plan for the future, and have the confidence that if things go wrong we’ll be there to put it right.

- We have been taking care of people for more than 325 years, in line with our purpose of being ‘with you today, for a better tomorrow’. In 2024, we paid £29.3 billion in claims and benefits to our customers.

- In 2021, we announced our ambition to become Net Zero by 2040, the first major insurance company in the world to do so. While we are working towards our sustainability ambitions, we recognise that while we have control over Aviva’s operations and influence over our supply chain, when it comes to decarbonising the economy in which we operate and invest, Aviva is one part of a far larger global system. Nevertheless, we remain focused on the task and are committed to playing our part in the collective effort to enable the global transition. The scope of our Climate ambitions and the risks and opportunities associated with our Climate strategy are set out in our Transition Plan published in February 2025: www.aviva.com/sustainability/taking-climate-action. Find out more about our sustainability ambition and action at www.aviva.com/sustainability

- Aviva is a Living Wage, Living Pension and Living Hours employer and provides market-leading benefits for our people, including flexible working, paid carers leave and equal parental leave. Find out more at www.aviva.com/about-us/our-people/

- As at 30 June 2025, total Group assets under management at Aviva Group were £419 billion and our estimated Solvency II shareholder capital surplus as at 30 September 2025 was £7.0 billion. Our shares are listed on the London Stock Exchange and we are a member of the FTSE 100 index.

- For more details on what we do, our business and how we help our customers, visit www.aviva.com/about-us

- The Aviva newsroom at www.aviva.com/newsroom includes links to our spokespeople images, podcasts, research reports and our news release archive. Sign up to get the latest news from Aviva by email.

- You can follow us on:

- X: www.x.com/avivaplc/

- LinkedIn: www.linkedin.com/company/aviva-plc

- Instagram: www.instagram.com/avivaplc

- For the latest corporate films from around our business, subscribe to our YouTube channel: www.youtube.com/user/aviva