Natasha Felmingham, Senior Propositions Manager, on the joy of badges and finding missing millions.

Trigger warning: this article references pregnancy loss which may be upsetting for some. Please consider the potential impact on your own wellbeing before reading.

Natasha Felmingham, Senior Propositions Manager, on the joy of badges and finding missing millions.

I work in UK savings and retirement. My job is to understand customer problems and solve them through our products and services. If I do a good job, I help make Aviva profitable.

Take the Aviva Drive app. We were looking for a way to help Aviva’s car insurance stand out. What we found, by listening to customers, is that they didn’t think car insurance was fair.

How could we make it fairer? Our first thought was telematics. See, if you record how people drive, you can reward safer drivers – those less likely to have an accident and claim – with discounts.

But telematic boxes, which you put into cars to record driving behaviour, proved too expensive. Then someone suggested using GPS in mobile phones instead. So that’s what we did.

On the psychology of scoring

After a lot of research and staff testing, we tested Aviva Drive with customers. Once they’d driven 200 miles, they got a score based on cornering, accelerating, and braking skills.

But driving 200 miles takes quite a long time. People got fed up waiting for their score.

So, we came up with the idea of badges. If people demonstrated, say, good cornering skills they’d get a virtual badge for that straight away. Customers loved badges - some even wrote to us asking how they had to drive to get them.

Then came score time. People were unhappy if they got a score of five, even though discount-wise it was the same as a seven. A five was insulting, so we tweaked the algorithm to reflect that.

Everything we learned helped make Aviva Drive a success. Despite some early negative feedback, customers enjoyed pitting their driving skills against their partners and friends.

That was back in 2012. You can still get a version of Aviva Drive today - it’s called Aviva Journey.

On how I ended up here

When I was little, I wanted to work in a sweet shop so I could eat sweets. Then a library so I could stamp books. Then, as I got older, I wanted to be a researcher.

At university, I studied history. I liked researching what happened in history and asking, ‘What are people’s views on that? What’s my view?’ I still use those skills today: researching, compiling evidence, and drawing conclusions - only now it’s about how to tackle customers’ problems.

How I ended up at Aviva is probably the same as a lot of people. After university, me and my friends wanted to move in together so we took the first jobs we could find to pay the rent.

For me, that was a job at Aviva selling car insurance. I was 21 and I loved it. It was all people about my age - we had such a laugh and learned loads. I liked talking to customers and helping them.

After 18 months, I crossed paths with a colleague, Anna, who saw potential in me. She gave me my first break in product development, nurtured me and put me through my marketing qualifications. Anna gave me the opportunity to be the person I am today, and belief in myself.

I’ve been here 21 years now. Aviva is the only place I’ve worked, and I've been lucky to try different roles. Last time I came back from a difficult maternity leave, I knew couldn’t go back to who I was before and so I moved on again, to savings and retirement.

On finding silver linings

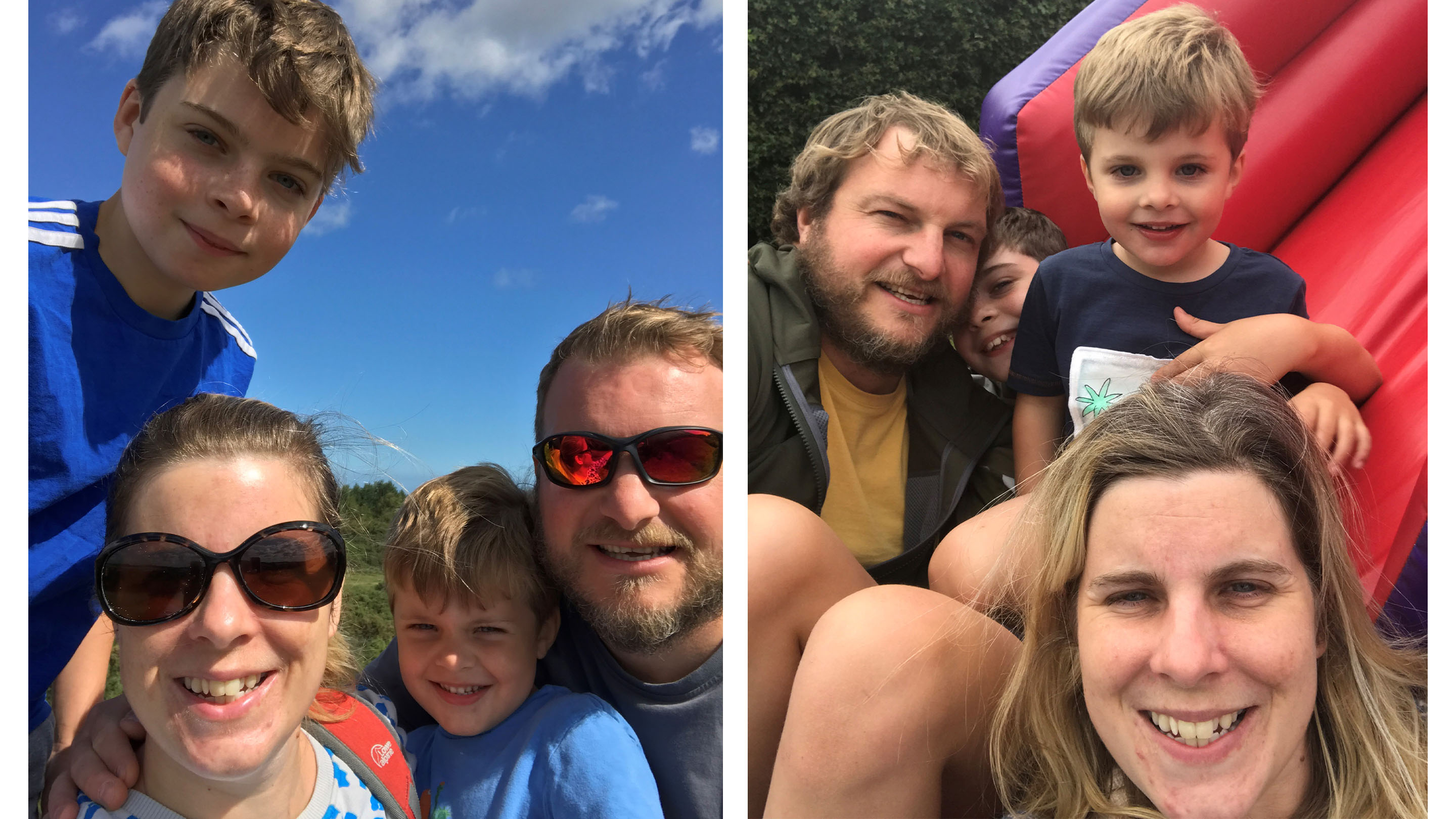

I'm a mum of two boys, 13 and 5. Juggling a career and being a mum, I've not always found that easy. Especially coming back to work after my last pregnancy.

My little boy was a twin, but we found out that there were issues at the 20-week scan. His brother died at 22 weeks. Later, the hospital made a mistake that led to me having an emergency operation.

We had to make horrible decisions that no parent ever wants to make. The whole experience was traumatic – going through all of that, it was the toughest point in my life.

I suffer from anxiety now, particularly when it comes to my children. I have a fear of doctors, I find it hard to trust them because out of however many they’ve helped, I was one of the few they got things wrong for.

My experience helped me reprioritise. I care so much about my family, my job, my friends… but now I know it’s ok to say ‘no’ or ‘I don’t feel great today’ or ‘I'm finding this difficult.’ That’s a good thing.

I was always quite aware of people’s emotions, quite empathetic, but I’m more so now. That helps with my work because I can understand how others feel and see things from their perspective.

On reading between the lines

Customer research is never going to tell you everything you need to know. One group of customers might say something is a terrible idea, the next will say it’s fabulous.

I’m working on some customer research to understand how people feel about putting all their pensions into one pot. Some people tell us it's risky putting all your eggs in one basket. But research shows over a third have considered it, and about the same number have done it.

So, I always consider customer feedback alongside other data and research. Then I translate all of that into something useful, something that solves a problem. But there’s risk in that translation - there’s always a chance I’ll get it wrong.

That’s why we develop products in an agile way, step by step. At each stage, we go back to customers for more feedback, and we respond to their feedback. That way, we don’t waste time and money, and we can develop better products and services for our customers.

On the forgotten billions

I’m working on a project to reunite people with lost pensions. Some people forget about pensions, others remember ones they paid into years ago, but they’ve lost the paperwork.

We’re working with two start-ups – using artificial intelligence and machine learning to make pensions tracing scalable and economically viable. One of the challenges is that pensions tracing is an expensive, manual process. So, we want to use technology to make it cheaper as well as easier.

There’s billions in lost or forgotten pensions and the average lost pot is over £20,000 – that’s not insignificant. It’s an exciting problem to tackle.

I'm learning loads about pensions and investments, but there’s still more to learn, more we can do to help our customers. There's an advice gap in the in UK, and a real opportunity to help people.

On things that endure

My dad, he’s about to retire and he’s like, ‘I don't know what I'm supposed to be doing’. That, and my work, have made me think about my own future.

Family and work is a constant juggle, but now my youngest is getting a bit older I’d like to invest more time in myself.

Career-wise, I’m thinking: What skills do I need for my future?

Outside work, I like making real things. Like upholstering a chair or throwing a pot – enduring things I can say ‘I made that’ about. Working with my hands gives me a sense of achievement and wellbeing.

On teenage strops and good advice

I’ll always remember the advice my dad gave me. We were on a beach in France, and I was having one of my teenage strops. He said, ‘If you try, you will never fail.’

When it would’ve been easy to stay in the same role, dad’s advice has pushed me to take a risk, try something new. And I don’t give up easily. Like with Aviva Drive, despite getting negative feedback from some focus groups, we didn’t give up. We found ways around it, and it paid off.

Dad was right. Even when things don’t work out, you always learn something, even if that’s how not to do it next time. But if you don't try at all, you will always fail.

***

Support link: www.sands.org.uk - Sands offer bereavement support for people who've been affected by the loss of a baby before, during or soon after birth.

It takes our people to make Aviva a great place to work. For more on life at Aviva, follow us on LinkedIn, Instagram and X.